Georgia Ethics Code Does Not Apply To Fulton Judges

Unchecked Power Cultivates Judicial Back-Scratching

In what should have been a no-brainer recusal of a biased judge, a slew of Fulton County judges rallied behind their rogue colleague which tragically confirms the already perceived level of integrity held by the Fulton County judiciary.

This article comes as an unanticipated "Part 3" in a sequence of articles following Derrick Jackson, a man on fire who was robbed just days before Christmas of his due process rights under the Constitution by Fulton County Superior Court Judge Melynee Leftridge. After Jackson took to the media about the situation, his family was thrown out of their home located in The Country Club of the South by the Fulton County Sheriff’s SCORPION Unit without a proper court order.[1][2]

Beginning in May of 2020, Jackson had been making payments toward the purchase of a home located in The Country Club of the South. As is known, home values have been skyrocketing since at least September of 2021 and, at some point amidst this modern day gold rush, the seller decided he no longer wanted Jackson to buy the home and subsequently hired a company to stage an eviction, which was inevitably botched resulting in what appears to be an array of backdoor dealings among Fulton County Superior Court Judges, the Sheriff and lawyers—or is it all just one big coincidence? Let's review the facts, and you be the judge.

The Country Club of the South: Fulton County’s Very Own Mar-a-Lago

The situation stems from a combination of written agreements between home-sellers Arthur M. McCracken and Julie L. McCracken and home-buyer Derrick Jackson.

Jackson was purchasing 955 Tiverton Lane, Johns Creek, GA, from the McCrackens in the luxurious gated community more formally known as The Country Club of the South. Jackson had already put a $100,000 down payment on the home, was making payments of $15,000 per month, and had paid thousands in property taxes, HOA fees, and repairs and maintenance to the property over a period of two years.

"Over the years, a number of celebrities have reportedly owned homes in Country Club of the South, among them retired Atlanta Braves pitcher Tom Glavine, Usher, Whitney Houston, and NBA Hall of Famer Allen Iverson. The neighborhood has 19 tennis courts, an 18-hole, golf course designed by Jack Nicklaus, basketball courts, a concert venue—and, of course, 24-hour security." [3]

Though the McCrackens hired a property manager to execute an eviction, this was obviously not a typical landlord-tenant case—with an alleged rent of $15,000 per month after a $100,000 down payment under a Purchase and Sale Agreement. Having committed to removing Jackson as their buyer, the McCrackens’ property manager refuses to drop the case despite having failed to deliver proper legal notices before initiating the eviction (or "dispossessory") process. At the time the case was filed the real estate market was getting exponentially warmer and it appeared to be in the McCrackens’ interest to pocket Jackson’s investment and seek a new buyer. Jackson offered multiple times to simply pay off the running balance and continue with the purchase, to which the McCrackens’ attorney has repeated "Not a chance!" Clearly, it was never about rent, it was about the sale. But why?

The Mythical "Staged" Eviction: Fact Meets Fiction

In a typical eviction where a tenant fails to pay rent, a landlord would initiate a dispossessory action with the court on grounds of "nonpayment" of rent. And if the tenant comes up with the money owed, the landlord would drop the case and everyone moves on as before the case was filed. So what exactly is a "staged” eviction? We consulted with Jackson's attorney, Matthew D. McMaster and here was his explanation.

A "staged eviction" is when a landlord uses court procedures to remove a paying tenant by underhanded means. And if you have either (a) an unprepared tenant or (b) a corrupt or simply incompetent judge, a property owner acting in bad faith could easily be successful in his or her endeavor.

This often occurs when a property owner decides to sell the rental and they no longer want the tenant in the home under any set of circumstances (which is what we have here). And when there is a written lease and the tenant is solvent, it makes an eviction very difficult. Well, in Jackson's case, we not only have a solvent tenant and a written lease, but we also have a Purchase and Sale Agreement between the McCrackens and Jackson signed a day after the alleged lease agreement. To make matters even more complicated, the McCrackens aren’t even a named party to the eviction case.

The easiest way to get a tenant to simply stop paying his or her rent (and every landlord attorney knows this) is to demand some absurd amount so as to induce the tenant not to pay any money at all. Imagine for example that you owe the present month's rent, for say $2,000, and your landlord demands $4,000 due within three (3) days for both the present month and the previous month's rent though you know for a fact you already paid the previous month's rent. The natural response by an unsuspecting tenant is to not pay a dime! Then the landlord will file with the court to have the tenant evicted and will inevitably win—though the money judgment will be less than requested by the landlord in the original demand. And thus, the staged eviction is completed in a manner that appears "legal enough" so as to avoid criminal prosecution.

"As an experienced landlord-tenant attorney—often times defending tenants—I have been privy to witnessing behavioral patterns of many landlord attorneys and judges that are complicit with these tactics, and it is very sad to say the least. Whether you have flat out corruption or if you have a judge who simply isn’t paying any attention to detail, it's a very scary situation." McMaster continued: "The other judges turned a blind-eye when we sought removal of Judge Leftridge and relief from what we perceived to be blatant impropriety in Jackson's case. It was almost as if they were saying 'It doesn't matter what the law says, we aren't going to remove our friend from the bench.'"

Because neither of the McCrackens are a named party to the eviction case, Jackson could not address his title and breach of contract disputes in a counterclaim. So in January 2023, Jackson filed a Petition For Quiet Title And Complaint for Breach of Contract against "All The World" and the McCrackens.

Looks Like Mortgage Fraud, Smells Like Mortgage Fraud

It'd be easy to write off this eviction attempt your everyday act of "greed" in light of a hot real estate market. But Navigating Justice's investigative team has uncovered information that paints a much different, darker picture. Here's what we know:

Facts

- On May 17, 2020, Derrick Jackson entered into a Lease for Residential Property with Julie and Mike McCracken requiring that Jackson pay $15,000 per month in rent for Jackson and his children to reside at 955 Tiverton Lane, Johns Creek, GA (the "Property").

- On May 18, 2020, Derrick Jackson entered into a Purchase And Sale Agreement with the McCrackens to buy the home for $1.8 million, depositing $100,000 in earnest money, plus rolling over $10,000 from a previous agreement with the McCrackens. At the time, Bank of America was the mortgagor to the Property and Mike McCracken, the mortgagee, was adamant that Bank of America not know about the Purchase And Sale Agreement.

- On May 25, 2020, Derrick Jackson gave an additional $15,000 for The Country Club of the South homeowners' membership, though Jackson later learned that the actual Club cost was only $7,500, which meant Mike McCracken misrepresented the actual costs resulting in a net profit to McCracken of $7,500 on the transaction.

- On September 24, 2020, Jackson paid $13,957.20 in property taxes to the McCrackens.

- On October 20, 2020, the McCrackens purchased a home for $630,000 in Mount Dora, Orange County Florida with a $504,000 promissory note, making a presumed down payment of $126,000.

- In September 2021, the McCrackens hired Paramount Properties Management Group LLC ("Paramount") to collect payments owed to the McCrackens under the lease and the purchase agreements from Jackson.

- On October 6, 2021, Jackson tendered a check for $22,500 to the McCrackens for property taxes.

- On October 7, 2021, the McCrackens purchased a $57,250 white Mercedes-Benz GLE SUV. Later that month Jackson tendered an additional $22,500 for property taxes (totaling $45,000 paid to the McCrackens in property taxes for 2021).

- On January 24, 2022, Paramount jumped the gun on the eviction process against Jackson. To date, Paramount still refuses to drop the case despite Paramount not even being Jackson's landlord--Paramount only claims to be the agent of the McCrackens.

It Is What It Is...

The above shows that the McCrackens made large asset purchases whenever Jackson paid to them substantial sums of money. All the while Mike McCracken claimed that he owed Bank of America $1.8 million, which Jackson came later to find out was almost $300,000 more than the debt amount shown on the Security Deed for the Property (which showed $1.52 million). Bank of America, completely unaware of the of the Purchase Agreement described above, later transferred the mortgage to FirstKey Mortgage LLC in January of 2021.

All that being said, what at a glance appeared to be the result of simple greed was more likely an act of necessity. If it is true that the McCrackens cannot catch up on their mortgage (now owned by FirstKey), the McCrackens have no choice but to renege on their Purchase Agreement with Jackson and sell the property for full price to a fresh buyer, making a "staged" eviction their ONLY chance out of debt with the mortgagor. And without recusal of the complicit Fulton County Superior Court judges, the McCrackens may very well succeed.

The Courthouse Shell Game

There are two ways a judge can be recused (or "removed") from a case: (1) voluntarily and (2) involuntarily. The latter, at least in Fulton County, occurs amongst flying pigs and unicorns. Jackson's case has extracted that fact pretty clearly.

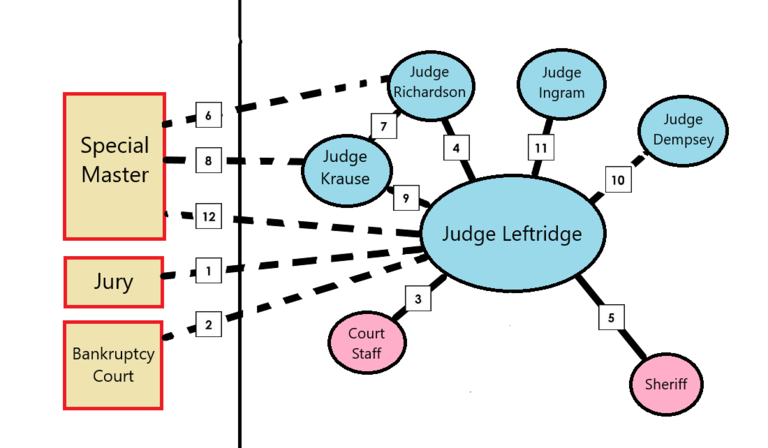

On March 23, 2023, Derrick Jackson filed a Petition for Writ of Mandamus and Writ of Prohibition demanding, among other things, the recusal of the entire Fulton County Superior Court bench after two of the judges (including Judge Leftridge) failed to recuse themselves from the eviction case despite conflicts, two judges (one in the eviction case and one in the Quiet Title case) refused to recuse Judge Leftridge, and three judges (including Judge Leftridge) all refused to appoint a special master, who's appointment is mandated by Georgia law in the Quiet Title case. To illustrate how the circumventing of checks and balances is done by Superior Court Judges, Navigating Justice developed the following chart based on court documents in Jackson's cases highlighting the key players and their respective roles:

1. On September 13, 2022, counsel for Jackson filed a Demand for Jury Trial into the eviction case with Paramount.

2. On October 21, 2022, Judge Leftridge's staff attorney informed the parties through email that there would not be a court reporter for the jury trial scheduled to take place on October 25, 2022 and that the Court would not delay the trial even if the parties could not secure their own court reporter. On October 24, 2022, Jackson filed for Chapter 13 Bankruptcy resulting in an automatic stay of the eviction case.

3. After the Bankruptcy stay was lifted, Paramount filed a motion for an immediate writ of possession ("eviction") and for the release of all funds that were in the Registry of the Court, which was estimated to be just over $115,000. Judge Leftridge's staff attorney informed the parties on December 21, 2022 at 11:03 AM that the Court was going to issue an order on Paramount's motion, which had only been filed the evening before, December 20, 2022. On December 22, 2022, the parties were served an order signed by Judge Leftridge for an immediate writ of possession against Jackson, the release of the more than $115,000 held in the Registry to Paramount and ordering Jackson to pay $30,000.00 more into the Registry of the Court no later than December 31, 2022. Counsel for Jackson had emailed the Judge's staff attorney earlier that morning only to receive an auto-reply stating that she was on vacation.

4. On December 28, 2022, Jackson filed a motion to recuse Judge Leftridge from the eviction case. Judge Leftridge signed a reassignment order on January 6, 2023 in light of Jackson's recusal motion and the motion to recuse was subsequently assigned to Judge Richardson.

5. The writ of possession ordering that Jackson be evicted from the Property did not include his fiance and children. However, on January 12, 2023, the Fulton County Sheriff Deputies used that writ of possession to remove everyone from the Property including Jackson's fiance and children.

6. On January 31, 2023, Jackson filed a Petition to Quiet Title and Breach of Contract against the McCrackens, which required the assigned judge to appoint a special master. That case was assigned to Judge Richardson but Judge Richardson did not appoint a special master.

7. On February 13, 2023, Judge Richardson voluntarily recused herself from the Quiet Title case but did NOT recuse herself from the eviction case. The Quiet Title case was re-assigned to Judge Krause upon Judge Richardson's recusal.

8. Judge Krause never appointed a special master in the Quiet Title action.

9. On February 17, 2023, Judge Richardson denied all three pending motions to recuse Judge Leftridge and the eviction case was then assigned back to Judge Leftridge. Judge Krause then transferred the Quiet Title action to Judge Leftridge on February 24, 2023.

10. On March 2, 2023, Jackson's counsel motioned to recuse Judge Leftridge from the Quiet Title action. Before Judge Leftridge signed the reassignment order as required by law, she set a hearing on the McCrackens' motion trying to stay the appointment of a special master. That hearing was set to take place on March 10, 2023 before the Honorable Judge Alford Dempsey. However, on March 9, 2023, the Court canceled that hearing in light of the pending resusal motion against Judge Leftridge.

11. On March 10, 2023, Judge Ingram denied Jackson's motion to recuse Judge Leftridge from the Quiet Title action and the case was assigned back to Judge Leftridge.

12. After refusing to appoint a special master in the Quiet Title action and other counts of apparent impropriety, Jackson filed a Petition for Writ of Mandamus and Writ of Prohibition against the entire Fulton County Superior Court bench of judges. That matter is still pending.

Based on the above, the actions (or inactions) taken (or not taken) by the Fulton County Superior Court judges and their subordinates are consistent with gaining and maintaining the most control over the outcome of the case, which is inconsistent with their duty to remain neutral and impartial. If they were neutral and impartial, they would have no interest in preventing a special master from taking jurisdiction over the matter. But they are certainly fighting hard to keep a special master from reviewing the case, VERY hard.

History Repeats Itself

If there was ever a question as to whether a judge would recuse another judge for violating Georgia's Code of Judicial Conduct, this case has removed the matter entirely from conjecture. We can now be sure beyond a reasonable doubt that the unwritten rule amongst the fraternity of judges in Fulton County supersedes Georgia’s ethics code. That unwritten rule is: No matter the facts and circumstances, a judge shall not remove another judge from a case.

The same lust for money and power that caused a lack of empathy and respect for human rights and allowed slavery in the South to once prosper is still here—though perhaps incognito.